FolioBeyond Fixed Income Commentary for January 2024

2023 Year End Review and Outlook for 2024

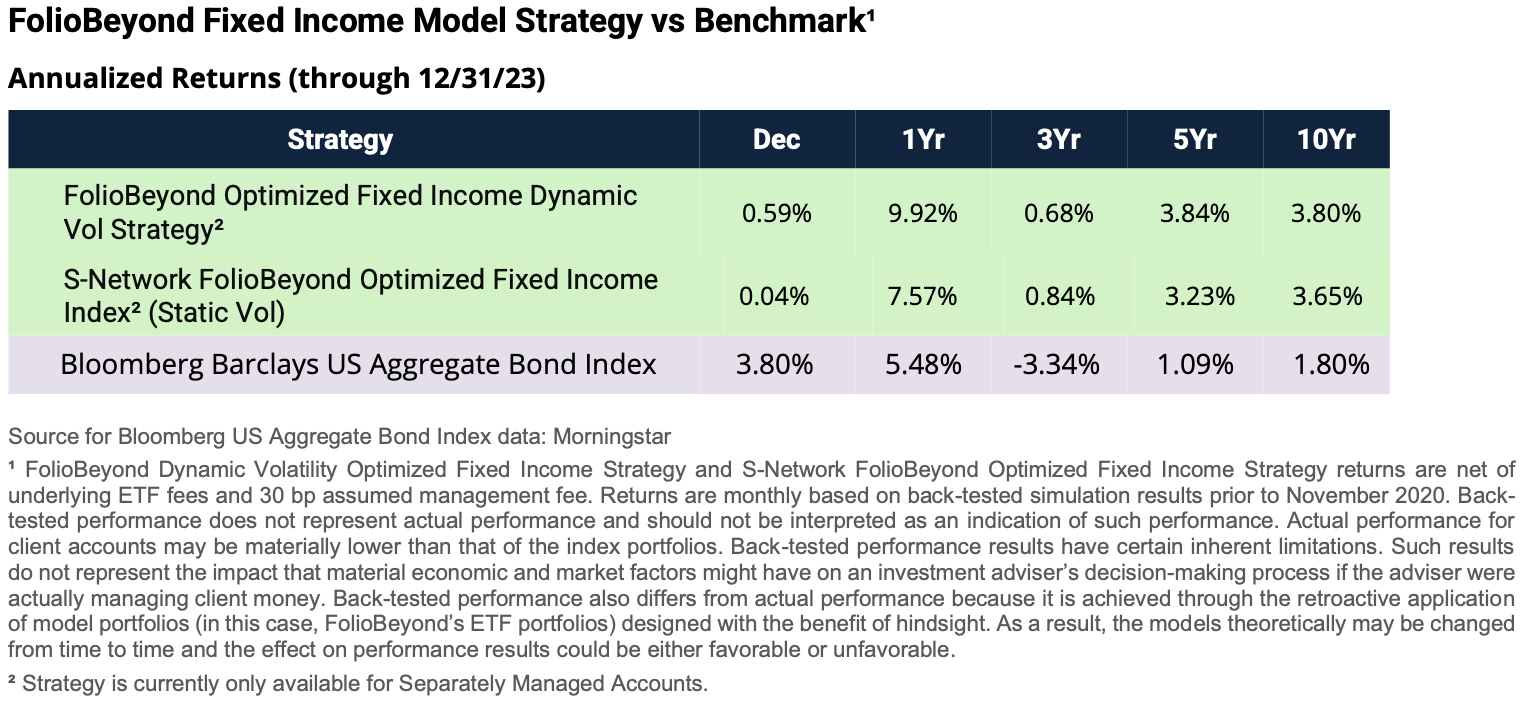

FolioBeyond’s ETF-based Fixed Income Models returned 9.92% and 7.57% in its dynamic volatility and static volatility versions, respectively, in 2023. These returns surpassed the Bloomberg Aggregate U.S. Bond Index return of 5.48% by 444 and 209 basis points. The performance summary and history are shown below.

Financial markets experienced unpredictable challenges in 2023 with various fundamental and technical factors remaining in flux. These drivers of market direction included pace of lower inflation, direction of economy, timing of reversal in Fed’s tightening policy, labor market strength, and credit risks, to name a few. The confluence of these factors not only impacted individual subsectors of the fixed income market but also the nature of correlations across asset classes that often flip-flopped. Market expectations combined with hyper focused reactions to single economic datapoints led to frequent overshooting of bond prices on a short-term basis before normalizing in subsequent days and weeks. This type of volatility made macro positioning ever more challenging. For fixed income investors, balancing short-term market movements with longer-term economic projections made portfolio positioning prone to less predictable changes.

olioBeyond has been utilizing an advanced multi-factor optimization process to construct risk-balanced portfolios using sector ETFs, providing attractive returns while generating sector rotation alpha. FolioBeyond’s Fixed Income Model uses an automated process to properly capture the major attributes that determine total returns, while maintaining risk levels within desired levels.

At year end, the model favored a mix of floating rate bank loans and short duration high yield corporate credit combined with high yielding mortgage REIT and MBS Interest Only Securities (“MBS IO”) exposures. Additionally, short duration TIPs were favored in the Treasury market. The general implication from this type of portfolio composition is to take credit risk and inflation risk at the short end in conjunction with a near flat duration in agencies by combining levered MBS (in a REIT) with negative duration MBS IOs.

Now, let’s delve into the inner workings of the model. First, income and forward-looking yield levels are quantified using a robust approach for pricing default risk, option risk, inflation risk and any other major factors that influence bond yields over time.

Second, risk levels are measured based on a proper analysis of historical returns that are adjusted to factor in current implied volatility levels. Correlation effects, especially negative correlations, provide advantageous combinations in a portfolio context. One component in our 24-ETF universe that stands out is the MBS IO exposure that is negatively correlated with practically all other ETFs in our mix.

Third, momentum effects, both upward and downward trends, are incorporated into the risk measure to either underweight or overweight sectors. Strong positive or negative momentum effects, as measured by our proprietary model, incorporate both short-term and long-term momentum trends.

Fourth, sector specific constraints and rebalancing thresholds are implemented. The end result of this multi-factor optimization process is an objectively constructed portfolio that reacts to ongoing changes in sector valuations and relative value dynamics while striking a balance between over-optimization and staying in close proximity to the ideal portfolio. Emotions and unintentional lack of oversight by individual portfolio managers are removed from the process.

As the performance numbers show, the outperformance of our model, particularly in recent years, demonstrates the benefits of a properly constructed optimization model that identifies the best total return opportunities within a portfolio context. The model can also be customized to fit the needs of investors’ overall fixed income targets vis-à-vis their non-fixed income exposures in equities and alternatives. Additionally, the exclusive use of ETFs allows the strategy to easily execute rebalancing transactions and avoid potential challenges of trading a large number of individual CUSIP bonds.