2021 Year End Review

JAMIE VICECONTE

CHIEF MARKETING OFFICER

CO-CHIEF INVESTING OFFICER

4 min read

It’s that time of year again – year-end review time, that is. While we have tried in our notes over the past twelve months to provide perspective on market movements, the end of the calendar year is everyone’s standard measure for how portfolios have done. So here we go.

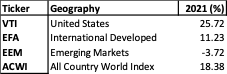

In looking at the broad indices, we will quote all return numbers on a total return basis, assuming dividends and those being reinvested over the one-year horizon. The source for all return data is Morningstar. Let’s start with geography.

As you can see in the chart below, US Equities, as represented in the VTI ETF, dominated global equity performance, as captured in our Equity benchmark, MSCI’s All Country World Index (“ACWI”). International Developed (“ID”) markets had less than half the return of the US markets, and Emerging Market (“EM”) equities had negative returns overall. EM’s poor performance was driven primarily by China. China’s market cap-weighted index was down over 22% on the year.

There were consistent themes in US and EM equities when we look within each geography. In both markets, Value and Small Size equities, along with smaller companies filtered broadly for Quality, generally beat the market cap-weighted indices by 5%, and in the case of EM by as much as 19%. We have significant exposure to those factors in both geographies. In ID markets, Value and Small Size did not outperform, and Quality provided a modest 1-3% boost. Some examples of these relative performance results are below.

There were significant differences in performance across sectors in terms of Fixed Income, as shown in the table below. The Commodity-focused ETFs, which we have looked at as a proxy for inflation hedges in this low-rate environment, were the best performers. Utilities, another proxy for income, followed them. High Yield ETFs were next in the rankings, followed by Floating Rate Loan products. Virtually everything else was in negative territory, with the longest duration high-quality sectors performing the worst.

What does all that mean for our overall portfolio performance? Our equity benchmark, ACWI, was up 18.4% for the year. Our Equity allocation was up 15.3%. The underperformance was primarily due to a large Quality rebalancing which we did at the end of the 1st quarter of 2021, which entailed reallocating about 20% of the overall equity allocation to higher Quality and implicitly more Value-oriented indices. This underperformance reflected the tug-of-war between the work-from-home and re-opening sectors of the markets and has been a constant theme right into the new year. We remain confident with that repositioning, even if it did result in interim underperformance versus the ACWI benchmark.

Our Fixed Income allocations did outperform our benchmark, the Barclays Global Aggregate Index (“AGG”), for the year. The AGG was down 1.67% versus our allocation being up roughly 4.85%. This outperformance was attributed to core short duration High Grade credit positioning, our tactical model’s short duration High Yield exposure, and boosted by reasonable allocations to broad Commodities and Utilities. Starting with a low current yield, the benchmark suffered negative returns from a slight increase in nominal interest rates, offset by narrower credit spreads.

For a blended 60% Equity / 40% Fixed Income account, our allocations returned 11.15% versus the benchmark return of 10.36%, an outperformance of roughly 0.80%. All of these comparisons to benchmarks are after fees. The table below summarizes these performance numbers.

So as we enter 2022, the trends for Value, Small Size, and Quality appear to still be in place. In Fixed Income, we will be looking to other sources of current income with limited duration exposure and will continue to assess those in light of potentially rising interest rates. While everyone seems to be expecting more volatility this year, we all know how inaccurate predictions typically have been. That’s why we will stay the course confident that we are well-positioned for longer-term trends in the public Equity and Fixed Income markets.