FolioBeyond Fixed Income Commentary For March 2021

Performance Summary

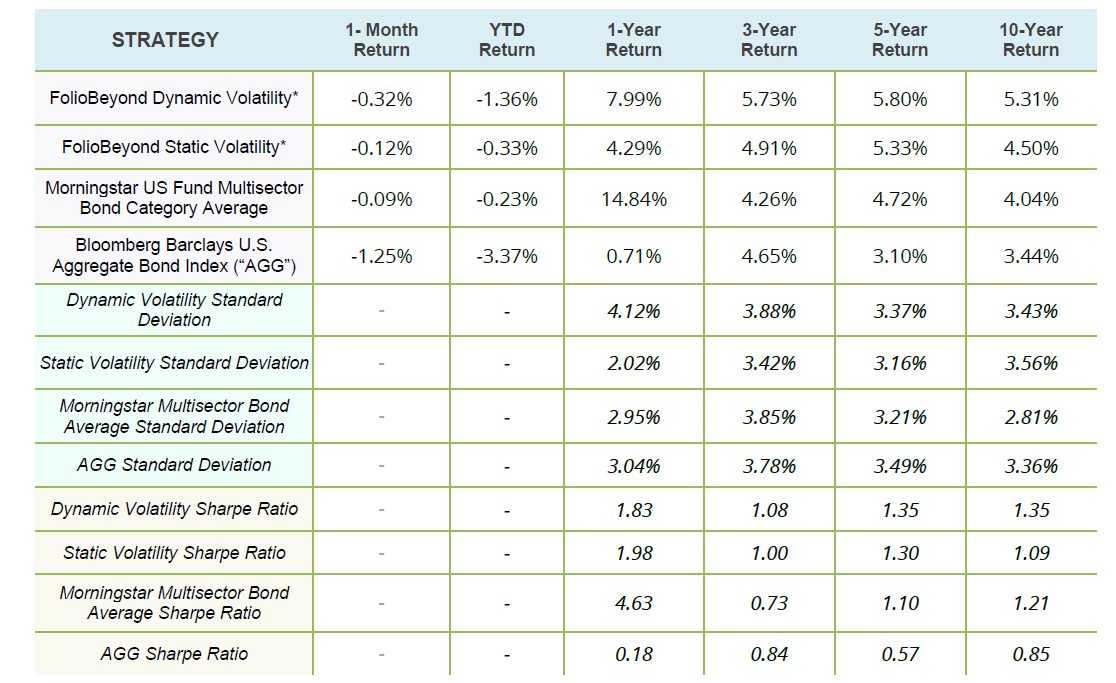

FolioBeyond's algorithmic Fixed Income strategy returned -0.12% and -0.32% in its static and dynamic volatility versions, respectively, in March. The strategies continued their historical outperformance versus the Bloomberg Barclays U.S. Aggregate Bond Index ("AGG") which returned -1.25%.

The outperformance of our strategies occurred with the backdrop of Treasuries' steepening selloff which maintained its trend in March, with the 2 to 10-year yield spread widening by another 28 basis points. FolioBeyond's algorithmic strategies have been positioned with a shorter duration profile than AGG but with higher current income, primarily from short-duration High Yield exposure. As the relative value relationships change, the model will rebalance the portfolio to maximize projected returns subject to risk constraints.

Source: FolioBeyond’s returns are from SMAs on Interactive Brokers (from January 1, 2019 for Static Volatility and from November 3, 2020 for Dynamic Volatility) and back-tested simulated results prior to that. AGG and Multisector Bond Category returns are from Morningstar.

* FolioBeyond Dynamic and Static Volatility returns are net of underlying ETF fees and 30 bp assumed management fee. Although the information herein is believed to be reliable, FolioBeyond makes no representation or warranty as to its accuracy, and information and opinions reflected herein are subject to change at any time without notice. The past performance information presented herein is not a guarantee of future results.

Highlight: Review of Fixed Income Risk Factors

Given fluctuations in the perceived pace of the economic recovery and inflationary concerns, investors need to capture the changing risk dynamics emanating from shifts in fundamental and technical factors. It is essential in the current environment to maintain a disciplined approach for quantifying the varying effects of fundamental factors.

To review the major drivers of value and risk in the Fixed Income market's diverse product sectors, we provide a qualitative overview of the significant risk dimensions present in a subset of the 23 subsectors we analyze on an ongoing basis. While some of the risk factors are clearly evident, such as the high duration risk in long Treasuries and Municipal Bonds, the combination of risk factors embedded in certain product types might be less obvious.

For example, while TIPs protect against rising inflationary expectations, there is a significant duration component in TIPs that can offset any gains from rising inflation if the environment is accompanied by increasing interest rates. Another example is Bank Loans, where the product's floating rate nature would make it insensitive to changes in intermediate and long-term Treasury rates. Additionally, since most Bank Loans have longer maturities, they are adversely impacted when credit spreads widen. This makes its spread duration risk more significant, especially in any rate move where credit spreads gap out. A third example is Mortgage REITs, where the leverage risk amplifies the prepayment risk in the underlying MBS portfolio.

The good news is that the diversity of risk-return profiles in the Fixed Income market allows for effective implementation of portfolio solutions that match institutional and individual investors' desired risk goals. FolioBeyond’s optimization approach evaluates the opportunity set across many discrete subsectors in the Fixed Income market. It produces optimal portfolio allocations while limiting the aggregate risk level to be equivalent to the broad AGG benchmark. The Fixed Income market's quantitative nature lends itself well for running comprehensive value and risk updates daily, with timely rebalancing transactions as required.

Please contact us to explore how our portfolio solutions can complement your overall Fixed Income exposure.