FolioBeyond Fixed Income Commentary For January 2021

Performance Summary

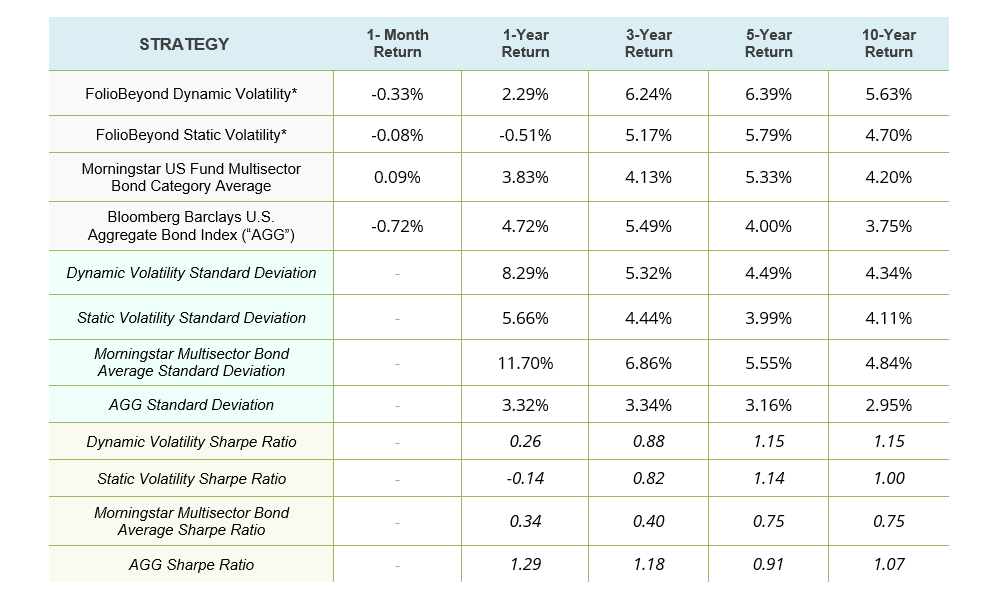

FolioBeyond’s algorithmic Fixed Income strategy returned -0.08% and -0.33% in its dynamic and static volatility versions, respectively, for January. In comparison, the Bloomberg Barclays U.S. Aggregate Bond Index (“AGG”) registered a -0.72% return. As a reminder, the dynamic volatility version targets the trailing 1-year volatility of the commonly followed AGG, which leads to higher risk targeting in more volatile environments like what we experienced during the past twelve months. The static volatility version targets constant annual volatility of 3.5% (generally corresponding to the long-term average volatility of AGG) which may be more appropriate for portfolios with a set risk budget.

The Treasury yield curve continued to steepen with the 2- to 10-year yield spread widening by another 20 basis points in January. As the 10-year Treasury yield rose by 18 basis points during the month, longer duration strategies suffered additional losses. While our algorithmic strategy has some longer duration risk, the overall portfolio is shorter than AGG’s duration of 6.3 years (static vol strategy duration of 2.5 years and dynamic vol strategy duration of 4.2 years). Our current yield, however, is higher than AGG’s yield of ~1.17% (static vol yield of 1.53% and dynamic vol yield of 2.61%). In terms of return attribution for our strategies in January, gains in short duration credit exposures were offset by losses in intermediate/long duration Treasuries.

Source: FolioBeyond’s returns are from SMAs on Interactive Brokers (from January 1, 2019, for Static Volatility and from November 1, 2020, for Dynamic Volatility) and back-tested simulated results prior to that. AGG and Multisector Bond Category returns are from Morningstar.

* FolioBeyond Dynamic and Static Volatility returns are net of underlying ETF fees and 30 bp assumed management fee. Although the information herein is believed to be reliable, FolioBeyond makes no representation or warranty as to its accuracy, and information and opinions reflected herein are subject to change at any time without notice. The past performance information presented herein is not a guarantee of future results.

Highlight: Hunt for yield and risk management

The current low interest rate environment compounded by a relatively flat yield curve has driven investors to search for additional income in riskier asset classes such as closed end funds with REIT or Middle-market Credit exposure, Preferred Stock, and other income producing strategies. Diversification into these other asset classes can yield strong benefits but they come with added risks. Investors need to quantify the risk/return tradeoffs properly and evaluate their fit relative to their overall portfolio goals. We outline below some salient aspects of risk management that should be incorporated when evaluating non-core exposures.

An enduring principle in the financial markets is CAPM, which quantifies the expected return of an asset in relation to its risk. Treasury bills are at the low end of that spectrum while high-growth technology stocks are at the other extreme. In the fixed income market, examples of high-risk strategies include long duration and high credit risk exposures (e.g., High Yield Municipal Bonds) and leveraged strategies (e.g., Mortgage REITs). In these non-core strategies, whether it is additional credit risk or leveraged prepayment option risk, the underlying risk factors need to be properly quantified to assess their fit in a Fixed Income portfolio.

Additionally, there are hybrid sectors that cross over multiple asset classes such as property REITs, Convertible Bonds, and Preferred Stock. In these sectors, non-Fixed Income risks such as underlying Equity exposure in Convertibles or Real Estate exposure in REITs, need to be accounted for properly. A traditional Fixed Income risk management framework is harder to apply to Convertibles and Preferred Stock. A hybrid risk measurement approach that combines both Fixed Income and Equity risks is more appropriate.

While quantifying the individual sector risks is important, correlation and diversification effects across various sectors also need to be evaluated. For example, a Mortgage REIT strategy alongside a passive core bond exposure that is heavily tilted toward US Agency MBS would provide minimal diversification benefits since REITs provide leveraged MBS exposure in a closed end fund format. However, Mortgage REIT exposure alongside a High Yield Municipal Credit strategy would provide significant diversification benefits.

Backward looking historical return data should always be utilized with caution, especially since the market has experienced a decades-long bull market in bonds. While the AGG index performed well in 2020 due to its static long duration exposure and the Fed’s support of Treasuries and MBS, the dynamics might be completely different even in a mild selloff in bonds or a further steepening of the yield curve. Investors need to focus on forward-looking return expectations and risks that will drive future returns. Historical returns only inform us about results in one specific scenario.

FolioBeyond’s algorithmic, multi-factor model is designed to capture the major sources of risk and return across 23 sub-sectors in the Fixed Income market and produce optimized portfolio solutions subject to appropriate risk constraints. As markets change and relative value and risk relationships drift, the model updates the optimization results daily with up-to-date analytics and rebalances the portfolio when risk levels change by more than 15%. It is this type of disciplined, systematic investment process that should make a difference for generating long-term success in portfolio management.

Please contact us to explore how our optimized portfolio solutions can help you manage your overall portfolio effectively.